THE BOTTOM LINE

The powerful stock market rally of this past week finally pushed TATY into the red zone and STERLING appears to be constructing a negative divergence. This is happening with another potentially lower price high under construction. After seven weeks of countertrend rally the implication is that it may be time for investors to go to a “Battle Station” footing in anticipation of the resumption of the bear market in the days, possibly weeks ahead, if a new “BIG CHILL” warning is issued and confirmed by other supply and demand indicators. For now the inverted yield curve, which inverted almost 80 basis points this past week, continues to give T-bill investors a bit less than 5% virtually risk free, continues to look good to us in a world where every asset class except the American dollar is in a bear market.

HAPPY HOLIDAYS AND BEST WISHES FOR A HEALTHY AND PROSPEROUS NEW YEAR!

BATTLE STATIONS

Mr. Powell, the Fed Chairman, made comments in an interview this past week, which caused investors to believe that the Fed tightening cycle would end sooner than later. The stock market immediately rallied more than 700 Dow points. However, after yet another violent rally in stocks the net result was a few supply and demand indicators finally managing to move into range of overbought zones, some with a hint of fading strength. While the setup needs more development, the stock market countertrend rally now appears to be moving toward completion after a seven week rally off the S&P-500 October low.

TATY, which has already called the January 5th all-time high and two consecutive tops during bear rallies, has moved into position where another “BIG CHILL” warning may be completed at any time. If a “BIG CHILL” warning is issued while another lower high in the price is forming, then it will be “Battle Stations” for investors, because yet another rally disappointment for dip buying investors may just be the catalysts for the dip buyers to finally “throw in the towel” in frustration given the lack of evidence of a classic cathartic exhausted sellers bottom. Apologies for the mixed metaphors.

TATY — A REPRESENTATIVE OF A FAMILY OF STRATEGIC SUPPLY AND DEMAND INDICATORS

TATY is shown above in yellow with the S&P-500 overlaid in red and blue candle chart format. TATY finally made it into the red zone surrounding the 140-level finishing the week at 141. Should the TATY rally fail in, or near the red zone, then another “BIG CHILL” warning would be completed, for the fourth time this year. This would substantially increase the odds that the countertrend rally in the price was vulnerable to also failing.

The rally into the all-time high in January took four weeks, the bear rally into the March rebound rally top took four weeks, the bear rally into the August rebound top took nine weeks, so the current rebound rally appears to be “long in the tooth” compared to the three previous tops post “BIG CHILL” warnings. Complex corrective formations can linger longer than expected, but the current one appears to be showing some early signs of exhaustion. So, constant vigilance is required, because once “a point of recognition” is reached, then the volatility and acceleration in the price lower has the potential to become both surprising and dramatic. Can the complex correction string out the onset of this outcome? Yes, of course it can, but bear markets do eventually reach “points of recognition” and the resulting price declines are often swift, persistent and powerful, until the sellers finally exhaust their desire to sell.

SAMMY — A REPRESENTATIVE OF A FAMILY OF TACTICAL SUPPLY AND DEMAND INDICATORS

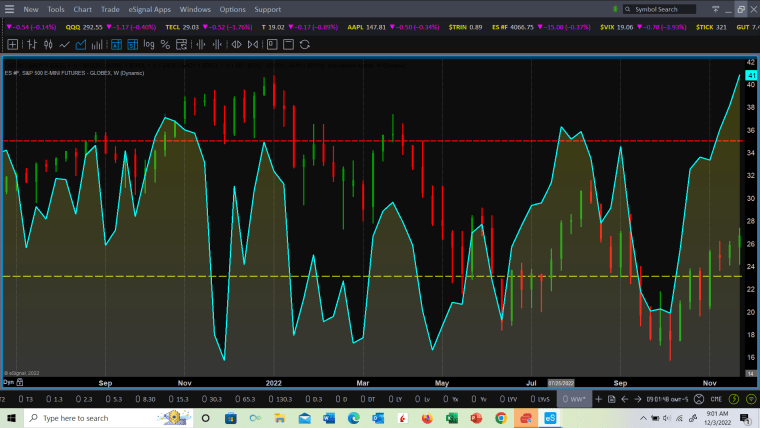

SAMMY is shown above in yellow with the S&P-500 eMini futures contract overlaid in red and green candle chart format. After breaching its long-term red dashed horizontal resistance line, SAMMY has powered on higher without forming any negative divergence. This implies that the price rally likely has more to go before becoming exhausted. Some fade in TATY accompanied by some negative divergence in SAMMY would be a nice development for the bear case but is NOT required. One always likes to see one indicator confirmed by other completely different indicators, which then strengthens the primary case.

STERLING — A REPRESENTATIVE OF A NEW FAMILY OF SHORT TO INTERMEDIATE TERM TRADING INDICATORS UNDERGOING TESTING

STERLING is shown above in the top panel, with the S&P-500 eMini futures contract shown in the lower panel. STERLING is in the process of developing a negative divergence (down sloping magenta dashed line) with the price (up sloping green dashed line). The longer the negative divergence, the more reliable the analysis. So, STERLING usually detects strength, or weakness first and is then joined by other supply and demand-based indicators. We shall see if STERLING is an early harbinger of more weakness in the price to come, or if a failure to be confirmed by other supply and demand indicators results in a resurgence of strength effectively wiping out this budding negative divergence.

Screenshots-1095 (above) and 1096 (below) are the S&P-500 eMini futures and cash indexes, respectively. Screenshot-1095 shows the next two chart resistance zones with dashed horizontal lines for the eMini futures contract. If STERLING’s negative divergence remains in place, then the lower orange dashed horizontal line would represent substantial resistance to any further rally. If resurging strength erases STERLING’s negative divergence, then the upper magenta horizontal dashed line would represent the next potential higher resistance level. So, the days and possibly weeks ahead are beginning to loom as critical for the return of the bear decline question.

Please notice how after breaching resistance the at red dashed horizontal line in Screenshot-1096, the price came back to rest on it before going on to challenge next resistance at the magenta dashed horizontal line, which was a tip off the rally was not done, fulfilling the concept that resistance once broken becomes support.

Screenshot-1097 (above) has been shown many times and is updated here for your additional information and perspective. The roughly drawn in white dashed lines represent a way any decline from here may develop and is not intended to be definitive of the actual outcome. However, in this representation the bear market decline holds short of S&P-500 2190, the March 23, 2020 low. According to this representation investors will have endured a “normal” correction of the last leg up originating from S&P-500 2190 in an ongoing bull market.

However, a breach of S&P-500 2190 on a closing basis would likely be a huge game changer implying a larger “degree” bear market was at work with very serious potential consequences for investors and global chaos socially, economically, politically, and geopolitically. Until such time as S&P-500 2190 is breached on a closing basis, we will be treating the current the bear market as a correction in an ongoing bull market. If S&P-500 2190 were breached, then we will publish the appropriate Fibonacci targets and support zones created by market action during the long rally to the S&P-500 all-time high at 4818 for the larger degree bear market, which we have already shown in previous updates.