THE BOTTOM LINE

The stock market is showing some signs of fatigue, and a pullback or correction to reinvigorate demand should not come as a surprise. The positive seasonal of roughly Halloween to Easter is on the cusp of entering its waning phase, so investors should not be surprised, if volatility begins to pick up. An S&P-500 close below 3880 would increase the odds of a pullback, or correction between now and the Ides of March, or later around Easter. Failure to manage a close below 3880 soon would imply an eventual assault on new all-time highs in a rally, which is looking increasingly fatigued.

A Chilly Stalemate

Back in my student pilot days, flying an airplane was sometimes described as hours and hours of boredom interrupted by moments of sheer terror. Any pilot, which has experienced an on board emergency, especially at night, has become acquainted with how quickly fear can overload the brain’s ability to process information accurately and timely; smoke in our cockpit late at night between Cedar Key, Florida and Moultrie, Georgia comes to mind. That whiff of smoke flying single engine in the darkness over land covered by tall pines, scrubby oaks, palmetto and rattle snakes got our instant attention, and provided us with more than our lifetime quota of those unforgettable “moments of sheer terror”!

Navigating the risks in the financial markets for clients can often find a kinship with flying an airplane, which is really just an applied physics exercise in risk management. When markets turn dull and listless some challenges in financial risk management are likely not too far in the future. However, no matter how long the markets may flash that they may be on the cusp of some serious volatility, it is often a bit of a surprise when the bears actually appear, even if they cannot take control for a lengthy period of time, or lack the strength to tip the market into an all-out bear market, as opposed to a normal periodic pullback, or correction to reinvigorate demand. Pullbacks and corrections are as normal for markets as breathing in and out is for you and I. The stock market does not like uncertainty, because that is when the bears are most likely to appear; hungry, motivated and angry. And, currently there are some signs that some catalyst(s) may be in the offing, which may cast a shadow of uncertainty on the financial markets.

TATY — A REPRESENTATIVE OF A FAMILY OF STRATEGIC SUPPLY AND DEMAND INDICATORS

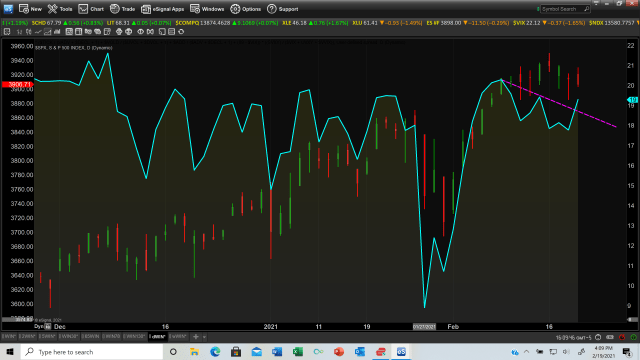

TATY is shown above in yellow with the S&P-500 overlaid in red and blue candle chart format.

TATY finished the week at 138 after failing to make it into the red zone beginning at the 140 level, and after a previous excursion into the caution zone surrounding the 115-125 level, which completed the first two steps of a “Big Chill” warning. While Lowry Research measures of the balance of supply and demand remain favorable for demand over supply, TATY has been setting up a “Big Chill” warning. This warning set of conditions have a history of preceding significant declines in bull trends, and reversals in counter-trend rallies during bear markets. TATY may yet be able to rally into, and perhaps above the red zone, but for the time being we shall take the budding “Big Chill” warning at face value, and be on the outlook for increasing volatility, and some price weakness.

Volatility did increase this past week, and some price weakness did manage to take out some marginal support, but the more important support surrounding the S&P-500 level of 3880 has so far resisted the would be decline. A close below 3880 basis the S&P-500 would likely imply the kickoff to a more significant decline, or outright correction lasting days, or perhaps weeks. However, if the bears fail to manage a close below 3880, then a renewed assault on new all-time highs would likely be the next significant movement in the S&P-500 and the Dow, but perhaps not in the NASDAQ. Given the strength in the Lowry Research measurements of the balance of supply and demand, any attempt to go lower would likely be contested by the bulls, as opposed to a collapse into an acceleration lower.

SAMMY — A REPRESENTATIVE OF A FAMILY OF TACTICAL SUPPLY AND DEMAND INDICATORS

SAMMY is shown above in Screenshot-206 in weekly format, and in Screenshot-207 in daily format in yellow with a blue border, and with the S&P-500 overlaid in red and blue candle chart format.

Screenshot-206 shows the negative divergence which developed between the SAMMY indicator and the price prior to the February to March 23 bottom as a magenta down sloping dashed line. A much longer negative divergence is shown by the down sloping orange dashed line, which shows that the SAMMY indicator never led the price higher after the March 23 low, which remains a source of frustration and caution that perhaps not all is well with the rally back to new all-time highs. In November SAMMY did manage to rally above previous resistance, shown on the chart as a horizontal magenta line, However, SAMMY has labored to go higher after successfully overcoming resistance, and now SAMMY has developed a new negative divergence with the all-time touching price shown on the chart as a down sloping yellow line. This means that while there is enough demand to power the price to new all-time highs, the overall balance of demand over supply according to SAMMY is significantly less than during the run up to the February 2020 then all-time high.

If a new bull market was minted at the March 23 low, then a reasonable analyst would expect TATY to be forming bottoms in, or near the red zone, and tops approaching the blue zone at the 160 level as strong bull trends of the past have done. Additionally, a case can be made that SAMMY would be confirming both TATY, and the price making new all-time highs. On the contrary, instead of SAMMY confirming it has painted out a multi-month negative divergence, and recently has begun an even sharper down turn, which is shown on Screenshot-207 (Daily Format) as a magenta dashed down sloping line. While both TATY and SAMMY could conceivably confirm the price touching new all-time highs at some point, to do so would appear to be beyond the pale without some serious corrective relief to reinvigorate demand happening first. Virtually anything is possible in the stock market, but one goes with the best probabilities, and a confirmation of a new bull market by both TATY and SAMMY without first a serious correction to reset demand would appear to have a low probability.

Please stay safe!